Time is running out to reach a debt ceiling agreement. Will the US default?

The Baltimore Post-Examiner reported in February that the failure to reach a debt ceiling agreement could wreak significant economic damage, and now in less than 10 days from June 1 — the date at which Treasury Secretary Janet Yellen has repeatedly warned that the government might surpass its borrowing limit — negotiations between House Republicans and the White House have yet to produce concrete results.

Republicans walked out Friday of a closed-door meeting with Biden administration officials. Major points of contention include a dispute over top-line numbers, and GOP requests for spending caps as well as work requirements for Medicaid recipients and possible additional work requirements to be eligible for other social safety net programs.

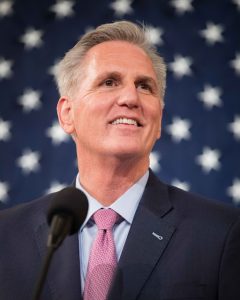

(kevinmccarthy.house.gov)

Earlier last week a deal appeared to have been within reach after President Joe Biden and House Speaker Kevin McCarthy and their respective teams had had a productive meeting at the White House, after which both leaders had said they expected to soon have an agreement to avoid default.

Biden and McCarthy are scheduled to meet again today to resume negotiations despite a weekend full of tense comments by both leaders while Biden was in Japan for a meeting with G-7 leaders. The president and the speaker spoke by phone on Sunday night.

As the clock inches ever closer to midnight, neither side appears to have shown any interest in a plan presented last month by the bipartisan House Problem Solvers Caucus that would not only stave off default, but also attempt to set up a process to address many of the concerns that are currently subjects of dispute.

The U.S. has never defaulted on its debt. However, the nation came to the precipice of default in 2011, and financial markets experienced a steep decline, with a near 20% drop in equity prices. The national debt now exceeds $31 trillion.

Some Democrats have urged Biden to invoke the 14th Amendment to circumvent Congress and unilaterally lift the debt ceiling so that the nation can pay its bills. The constitutionality of such a move has yet to be tested and could prove counterproductive if it were to become the subject of protracted litigation. Biden has said he believes such a move is probably legal yet impractical due to time constraints.

So, where does that leave things?

Is the situation worse now than it was 12 years ago? Why are lawmakers having such difficulty coming to an agreement on such a time-sensitive pressing issue? And is there still time to reach an agreement?

Former members of Congress say default is unlikely

“The possibility of default is real,” former Rep. Jason Altmire, a Pennsylvania Democrat, who served from 2007-13, told the Post-Examiner. ”

“There are some on the Republican side, including former President Trump, who question whether the impact of a default would be as catastrophic as most economists believe. But even among those who recognize the consequences, there is a critical mass of Republicans who believe the debt limit debate is the greatest leverage available to force the government to limit federal spending,” Altmire added.

Moreover, the debate that began in 2011 is still going on today, Altmire said.

“We are right now at the same point that Congress was in the summer of 2011. The rhetoric was heated and the new Tea Party members felt emboldened by their role in forcing the debate about spending. In the end, cooler heads prevailed and a deal was struck forcing deep spending cuts. But the difference now is exactly the experience of 2011. Republicans look at the 2011 compromise as a failed experiment, believing that agreement failed to provide the sustainable, long-term fiscal responsibility that was necessary. Many believe it was a mistake and the outcome is instructive on what type of agreement to avoid this time around.”

Former Rep. Alan Grayson, a Florida Democrat, who served from 2009-17, said default is rather unlikely to occur.

“Both sides would find it appealing to postpone the issue. No, it’s not too late, because both a long-term fix and a short-term fix can be passed with very short legislation that can be accomplished very quickly.”

Grayson said the situation is worse now than it was in 2011 due to indirect interference in negotiations by former President Donald Trump.

“Yes, because Donald Trump is instigating a default, and that makes it very difficult for the GOP to extend the debt limit as it did when Trump was president.”

Former Rep. Ron Klink, a Pennsylvania Democrat, who served from 1993-01, said default is rather unlikely but not impossible.

“I can’t comprehend anyone allowing a default, with the financial and political ramifications. Having said that, January 6 was unthinkable. We live in different times. I think they will come to an agreement….We live in a more dangerous time than we did 12 years ago. The radical Republicans of that time were tame in comparison and the Speaker then was somewhat stronger and certainly better prepared to ultimately do the right thing in the end.”

Former Rep. Ryan Costello, a Pennsylvania Republican, who served from 2015-19, expressed confidence that a deal can be reached and said it likely would have already happened were it not for the Biden administration playing games with GOP lawmakers.

“I don’t see default as the likely scenario. This is a new dynamic. I think that the administration has taken more time than they should have. The reason that it is coming down to the final few days is because the administration has been playing a game of chicken just to see what House Republicans could pass and what their bottom lines are. I think that Speaker McCarthy and his team have handled it exceptionally well.”

Former Rep. Gregg Harper, a Mississippi Republican, who served from 2009-19, said he is optimistic about a deal.

“First, never underestimate the resolve of Speaker McCarthy. It’s not too late, and I expect the President and the Speaker to work something out and avoid a default.”

Analysts agree that default is unlikely

“Regarding the likelihood of a default, I would say it is very very unlikely,” Richard Vatz, a professor emeritus who taught political persuasion at Towson University, said, “Both parties and their leadership have said that it would be “catastrophic” were the United States to miss its debt payments, and this classic game of “chicken”– who veers first to avoid a crash – will end as have others, before the awful results of depletion of government services, interest rates and possibly market panic, manifest themselves. Politicians have no difficulty stating their “best and final offers” and then retreating from them and congratulating themselves on their responsible avoiding of a crisis.”

Todd Eberly, a professor of political science at St. Mary’s College of Maryland, also said he expects a deal to be reached.

“I think folks would be shocked by how quickly legislation can pass if a true agreement is reached. So no, it’s not too late for an agreement. There’s also evidence of movement today (Sunday). Both sides will strategically leak stories to the press about stalled negotiations.”

Eberly said the proposal by the Problem Solvers Caucus likely was a non-starter because similar efforts had failed in the past.

“The biggest impediment to the House Problem Solvers Caucus plan is the House Freedom Caucus. There’s no way that they will agree to a clean extension until December 2023. Beyond that, we tried the “let’s create a commission” approach in the past. Back in 2011 we created a deficit reduction super committee of congressional Democrats and Republicans. There was agreement that anything the super committee approved would get a straight up or down vote in Congress (no filibuster) and Obama would sign it. The super committee never even met because staff could not find any common ground. There’s no reason to think things would be different if we went down that path again.”

Eberly said both major political parties are obstacles to bringing about fiscal responsibility.

“The situation is worse with regard to actual debt-but where it is especially worse is with regard to our politics. If compromise seemed difficult to achieve in 2011 it’s all but impossible today. The simple reality being that the only reasonable way to deal with our debts and deficits is via a combination of tax increases and spending cuts-including reforms to big budget items like Social Security and Medicare. But Republicans will not accept tax increases and Democrats won’t accept the reforms to Social Security and Medicare.”

Bryan is an award-winning political journalist who has extensive experience covering Congress and Maryland state government.

His work includes coverage of the election of Donald Trump, the confirmation hearings of Supreme Court Justice Brett Kavanaugh and attorneys general William Barr and Jeff Sessions-as well as that of the Maryland General Assembly, Gov. Larry Hogan, and the COVID-19 pandemic.

Bryan has broken stories involving athletic and sexual assault scandals with the Baltimore Post-Examiner.

His original UMBC investigation gained international attention, was featured in People Magazine and he was interviewed by ABC’s “Good Morning America” and local radio stations. Bryan broke subsequent stories documenting UMBC’s omission of a sexual assault on their daily crime log and a federal investigation related to the university’s handling of an alleged sexual assault.